|

December 2015

Article

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

The Rules are Changing in the Global Lighting

Controls Business

Add in the potential to at last open up

the latent retrofit market and it can be seen that there are enormous

opportunities for those able to understand the various market

influences and how to exploit them.

|

Allan McHale,

Director,

Memoori |

The

rules are changing in the Lighting Controls business and using the past

to judge the future would be very misleading. The competitive landscape

is changing and companies will have to develop new strategies to grow

and capture market share.

This is just one of the findings from Memoori’s latest world report Smart Buildings: The Lighting Controls Business 2015 to

2020.

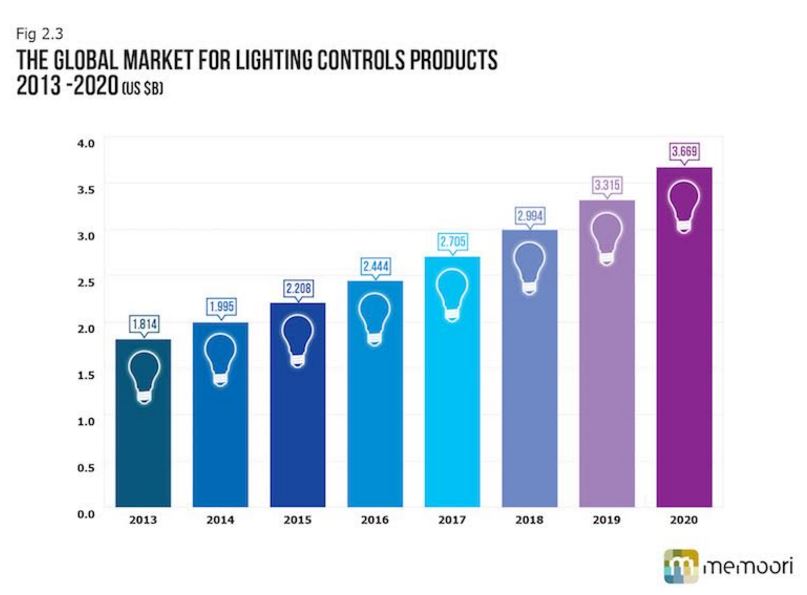

The report estimates the global value of lighting

product controls in non domestic buildings in 2015 at $2.208 billion at

factory gate prices. It also forecasts that the global market for

Lighting Controls from 2015 to 2020 will grow at a CAGR of 10.6% to

2020. Over the next five years growth in the developed markets of

Europe and North America will grow at a little more than half this rate

whilst China and Asia will exceed the average global growth.

This is indeed a high rate of growth particularly for a rather mature

lighting business where we expect unit hardware prices to fall

significantly but volume to compensate and software and value added

services to make a much larger contribution over the next five years.

So what are the changes that are

going to dramatically alter the competitive landscape and the structure

of the business?

- Changes in the Potential Value of

Lighting Control Products and the Benefits they Deliver.

- Technical Developments in both LED

Lighting, Lighting Controls and Wireless Communications.

- The Changing Landscape of the

Supply Side through Mergers, Acquisitions and Alliances and new

innovative players bringing with them new strategies to deliver the

Internet of Things in Buildings (BIoT).

The Lighting industry and many in the technical building

services industry now recognize that lighting is the most pervasive

service within a building; it reaches parts that none of the other

building services do. Combine this with the ability of solid-state

lighting to convey data through IP and for the sensors in the control

systems to gather data; there is a realization that lighting controls

are in a strong position both technically and commercially to take a

leading role in integrating most of the technical services in a

building.

Add

in the potential to at last open up the latent retrofit market and it

can be seen that there are enormous opportunities for those able to

understand the various market influences and how to exploit them.

These are just some of the subjects we discussed with

Tanuj Mohan, CTO of Enlighted in our Free Webinar last month – “Shining a Light on the Internet of Things in

Buildings; What part will Lighting Controls play in Future Smart

Buildings?”.

The report shows, through case studies, that this strategy to develop

the lighting control infrastructure to carry additional data and

functionality is already in operation; driving up the overall value of

a lighting control contract. However if Lighting Control companies are

to take advantage of this opportunity they will have to acquire new

technical skills and expand their routes to market.

[an error occurred while processing this directive]Of course this opportunity is open to other suppliers of

technical building services but if you just analyse the logistics it

would suggest that lighting and its control is a more likely core

network to build on for convergence and integration rather than

Building Energy Controls (BECS) or Plug-load. The answer lies in the

numbers – and in the ceiling. Lighting in most buildings is the second

largest energy load, but it easily represents the greatest number of

potential control points.

And when it comes

to building a reliable and scalable mesh network, the number of points

involved matters. Once a wireless lighting network is in place, adding

other devices and applications is simple – they piggyback on an

infrastructure that’s already in place.

The key difference that we have shown in the report is

that these controls applications and projects for medium and small

buildings will be lighting-centric rather than HVAC-centric and that

will make all the difference. The lighting-centric projects will be

motivated by LEDs and many will incorporate wireless and cloud

technology. This is resulting in the emergence of new players, new

technologies and new application delivery mechanisms. The existing

industry structure and business models will change dramatically over

the next five years.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]