|

November 2013

Article

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

|

It is the customers not the technology

that will disrupt the industry

I

have learned it is not the technology itself that causes the change but

rather the customer’s willingness to adopt the technology that will

drive the disruption.

|

Deb Noller, CEO,

Switch Automation, Inc.

|

In June I wrote an advisory around why rising consumer expectations in

property are set to disrupt the Real Estate Sector in an extensive and

volatile manner. My arguments were that many industries have already

undergone rapid and transformational change due to a convergence of

technologies that allow customers to fundamentally alter the way they

interact with the supply chain.

Retail, entertainment, airlines and communications are all examples of

industries that have experienced a radical and tumultuous change in

every aspect of their industry from the way they go to market,

advertise, transact, deliver and support their products and services.

When an industry reaches this tipping point where the technology can

underpin the required changes in commercial activity, the businesses

that fully embrace the new paradigm tend to do spectacularly well.

Those that continue business as usual but with some concessions to

technology change falter equally as spectacularly - think Amazon versus

bricks and mortar book stores.

I still believe it to be true that the underlying technology is the

driver for any revolution in industry transformation. But this year I

have learned it is not the technology itself that causes the change but

rather the customer’s willingness to adopt the technology that will

drive the disruption.

In November 2012 we attended Coretech to learn more about the North

American Corporate Real Estate market and to promote our viewpoint that

cloud will completely transform the way building systems are deployed

in the future. Our background in controls and automation combined with

software technology had convinced us by early 2010, pre the iPad, that

controls would be cloud based in the near future.

At Coretech 2012, we were struck by the number of large USA companies

struggling to collect building operational data into a single

enterprise-wide platform. Those case studies were exemplary examples of

how specific companies had solved the world-wide problem of

inaccessible building data spread across a vast array of disparate

systems and spread sheets throughout the organization and inside every

building. While those case studies were impressive, they are

arguably customized solutions for their patient and deep-pocketed

clients. Those solutions were built with huge collaborative efforts

between client, consultants and software providers.

Coretech 2012 illuminated that there is a mammoth world-wide problem,

an opportunity equal to any we have seen in the past 20 years, so why

isn’t it solved already? There is no shortage of software and hardware

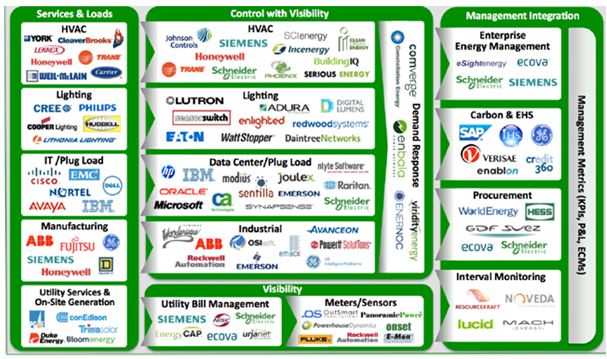

solutions for the property and building industry. Take a look at this

graphic below produced by Groom Energy; there is clearly a large number

of clever and potentially transformational solutions, some from the

large, traditional vendors and others from emerging technology

companies. Why are the customers not clamoring to adopt these emerging,

transformational technologies and deploy any number of the hundreds of

solutions already in the marketplace?

Source: Groom Energy 2013, Energy Smart Grid Vendor Landscape

I love this image – it certainly identifies one of the biggest problems

in the market, not just for the customers and vendors but also everyone

in between. This market noise is just one of the obstacles holding back

the transformation of the real estate industry.

I call this phenomenon “Software Fatigue”. A customer identifies they

have a problem and they know the organization could be more efficient

if they could find a solution that could solve their problem. The first

step is self-education so the person heading the project starts by

doing some internet-based research into possible solutions. The more

they look the worse it gets. Everyone on the project team knows about

some solution or other and when the project leader starts asking their

peers and industry cohorts, they find that everyone has either a horror

story to tell or yet another solution to add to this ever expanding

list of possible solutions that are difficult to differentiate.

And then the project stalls. How will a project manager identify the

best solution for their project if the industry itself is struggling to

differentiate all these solutions? How does one cut through the noise?

Our problem is slightly different; we have spent most of the last 12

months trying to identify the channel - what type of businesses will

address this emerging and colossal opportunity to move the property

sector into the next generation of change. The choices are widely

varied from electrical and mechanical contractors to green building

engineers, energy efficiency professionals, business consultants,

measurement and verification companies, system integrators. The list

goes on.

We are further hamstrung by the fact that IP-based systems in buildings

are not necessarily of interest to a whole market sector. Some

electrical contractors, for instance, are quite content running cables

and fitting power points. They have no interest in learning about

networking, IP technologies and so forth. Mechanical contractors

understand their business of keeping large air conditioning plants in

tune so buildings have comfort levels suitable for occupants. To

embrace change will not only require a major re-skilling in their staff

and a strategic change in their business plan but also a complete

change in their business model. There are no clearly identified market

segments for potential channel partnering and we need to find companies

that are both skilled and interested in strategic change.

Going back to the customer and their “Software Fatigue”, their problem

is that they need a software package that spans different needs and

automates as many tasks as possible while staying simple enough to use

for the various stakeholders. Things like fault detection, alerts,

scheduled reports and deep data insights are just the beginning. We

think more intelligent behavior around building data will evolve over

the next few years.

Another crucial problem, that nobody seems to have addressed so far is

seamless integration with other core business software such as ERPs

(SAP, JD Edwards, Oracle etc) which would include integration with work

order management systems, corporate finance, bill processing,

inventory, asset management, maintenance, HR (for user account

management), and so on.

Many of the current building management solutions are siloed at a

building level with building performance data and a user interface over

the top making them difficult to integrate into the business workflows

used in the real estate industry. We would argue it even goes further

than that. Currently we mostly see two separate silos within the

emerging building management industry; monitoring and analytics on one

side and controls, including demand response and load shedding, on the

other. The customer will be hard pressed to find an integrated solution

which does both in our industry. On top of that you'll find that many

software packages come with tight coupling with specific hardware,

reducing options for other integration.

[an error occurred while processing this directive]

The good news is that many of the newer entrants into the software

space understand they are only part of the overall solution and they

are building sophisticated 'hooks' or connectors between their own

software and other packages. This will be the bridging of the first gap

between the monitoring and analytics silo and the building controls

silo with the second wave bringing integration with traditional

corporate software.

The bad news is the customer needs a high level of sophisticated

knowledge to navigate through this landscape and select solutions that

will finally allow corporate real estate to be treated as part of their

business. One of the smarter things we have seen recently is large

companies adopting highly skilled building controls consultants to help

them in this process. Earlier this year we responded to a survey from

one such initiative that took us more than a week to complete. It was

by far and away the most knowledgeable, insightful and sophisticated

approach we have seen to date and I believe this is a sign of things to

come. The customer is driving the purchasing decision by enlisting

skilled advisors rather than allowing their existing service providers

to make that decision for them.

The other just as insightful thing we are seeing is large corporate

decision-makers recognizing that, here, today there is no silver

bullet. In 2013 there is no single software package that can solve all

of the functionality for all of the departments across a large

organization with hundreds or even thousands of buildings. They are

selecting solutions that can make a start on their big picture, solving

one aspect of their operations well. They take the approach that they

will solve one thing then grow the solution by introducing more

features from the same solution provider or by integrating compatible

solutions that can eventually provide them with a single seamless

solution. This is a smart approach because it contains both costs and

risk.

The shakeout will happen in the real estate and related fund management

industries. There will be players who adopt real time building

monitoring and management software at the core of their business and

build that solution out to integrate every other aspect of how they

manage buildings. When this tidal wave begins, it will be driven by the

customer and their need to run a much more highly efficient business

and the vendors, service providers, consultants servicing the real

estate sector will find enormous opportunity in the ensuing wake.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]