The 2016 Paris Agreement called for its nearly 200 signatories to join in limiting global warming to an increase of 1.5 degrees Celsius above pre-industrial levels. This would require carbon emissions to be reduced by about half by 2030 and reach net zero by 2050. To reach this goal, the rate of retrofits in the Global North will need to triple from barely 1 percent to at least 3 percent of stock each year, according to Retrofitting Buildings to be Future-Fit, a November 2022 report by commercial real estate services firm Jones Lang LaSalle (JLL).

Buildings are responsible for an estimated 39 percent of global energy-related carbon emissions. According to the World Green Building Council, this is the total of 11 percent from materials and construction and the remaining 28 percent from operational emissions—from energy required to light, heat, cool, and power them. As such, buildings provide a viable path to decarbonization, particularly existing buildings, as a majority of the commercial building stock—some 80 percent of buildings—that will be standing in 2050 has already been built.

Various U.S. jurisdictions have begun phasing in energy benchmarking with fines for building owners failing to satisfy energy efficiency or emissions requirements. Multiple state and local governments have passed building performance standard-based policies. According to Vert Energy Group, dozens of municipalities have adopted or are phasing in requirements. These policies aim for benchmarking and decarbonization and create large markets for retrofits.

One of the most prominent examples is New York City, whose Local Law 97 takes effect in 2024. This law sets carbon caps on buildings over 25,000 sq.ft., imposes large fines for exceeding these caps, and will drive toward net zero carbon emissions by 2050. These policies send a clear market signal to reduce carbon emissions or face financial risks in the form of penalties and negative impact on property valuation.

Decarbonizing existing assets can deliver a powerful upside. Early adopters of net-zero buildings will benefit from greater competitiveness in attracting and retaining tenants at higher rents, according to the report. Attracting and retaining high-quality tenants, which impacts net operating income, offers value for decarbonization measures beyond direct return on investment. In JLL’s 2022 Future of Work Survey, three out of four respondents said their organizations would be willing to pay more to lease a building with leading sustainability credentials. One out of five said they already have.

Conversely, inaction may impose on inefficient properties a “brown discount,” or steep value depreciation, as demand for net-zero properties increases.

“Rising energy costs will hasten the move towards efficient buildings and reinforce emerging value trends, with the financial risks of inaction already becoming apparent,” the report stated.

As tenant usage is a significant factor in reaching net-zero goals, JLL identified value in collaboration between landlords and tenants, which may create new business models, alter the economics of leasing, and reward co-investment approaches.

Decarbonization is an ESG value. Asset managers globally are expected to increase their Environmental, Social, and Governance (ESG)-related assets under management to nearly $34 trillion by 2026, up from $18.4 trillion in 2021, according to PwC’s Asset and Wealth Management Revolution 2022 report. One way to improve environmental performance is to reduce carbon footprint expressed in Scope 1, 2, or 3 emissions. The JLL report reported that 60 percent of the Fortune 500 currently have already put into place climate or energy targets.

Inaction may pose macroeconomic costs. “The transition to a low-carbon economy comes with a hefty price tag, but as recently declared by the International Monetary Fund, further delaying climate policies will hurt economic growth; the time to act is now,” stated the JLL report.

Decarbonization must serve people. Decarbonization involves maximizing operational efficiencies, electrifying heat, and sourcing off-site local renewable energy and building onsite renewables, with offsetting as a last resort. To maximize success, building owners should take a holistic, long-term approach that supports occupant needs, health, and wellbeing.

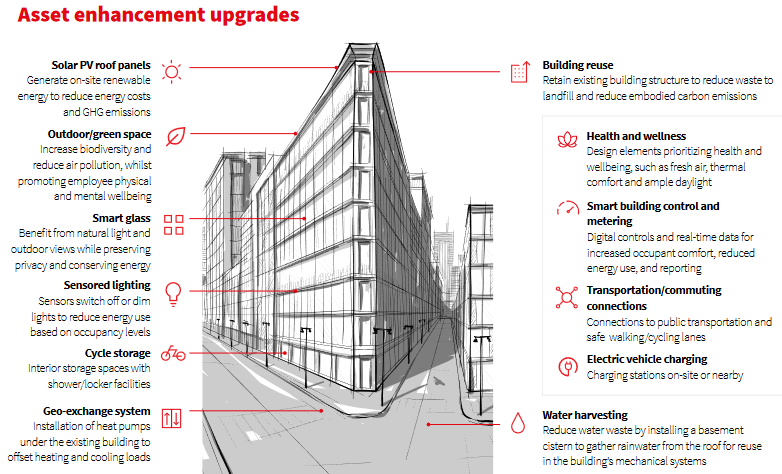

Lighting and controls can play a significant part in the transition. The JLL report identified a number of building asset upgrades, including solar photovoltaic roof panels, green spaces, smart glass for daylighting, cycle storage, heat pumps, electric vehicle charging, and water harvesting.

For lighting, the report specifically called out LED luminaires, detailed deployment of sensors, and digital controls that generate data that in turn can be leveraged for energy management, reporting, and to optimize occupant comfort.

Existing buildings can lead the way to net zero. “The technology, systems, processes, and means to reach net zero carbon and beyond exist today, but there is no one singular strategy, technology, or entity that will address the journey and there is also no one-size-fits-all approach,” the JLL report concluded. “While the scope and complexity of the challenge is immense, retrofitting existing buildings is the quickest and most cost-effective way to accelerate decarbonization in the built environment.”

Click here to download Retrofitting Buildings to be Future-Fit.