|

December 2014

Article

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

|

Access Control Upstages Video

Surveillance in the Quest for Driving Growth

Access

Control, for so long

the poor relative of Video Surveillance, this year has come out of the

shadows and upstaged it by delivering a higher growth rate and we

forecast that it will continue to increase its growth rate over the

next five years.

|

|

Poor

trading conditions right across the developed world in recent

years have caused physical security equipment buyers to hold back on

replacing old systems unless they can be sure that the new systems

improve the effectiveness of security, reduces operating cost and

delivers an improved and satisfactory ROI on their investment.

There is only one way to meet this challenge and that is for

manufacturers to continue with their innovation programs of delivering

more effective systems at lower prices and through convergence with the

business enterprise deliver value add services.

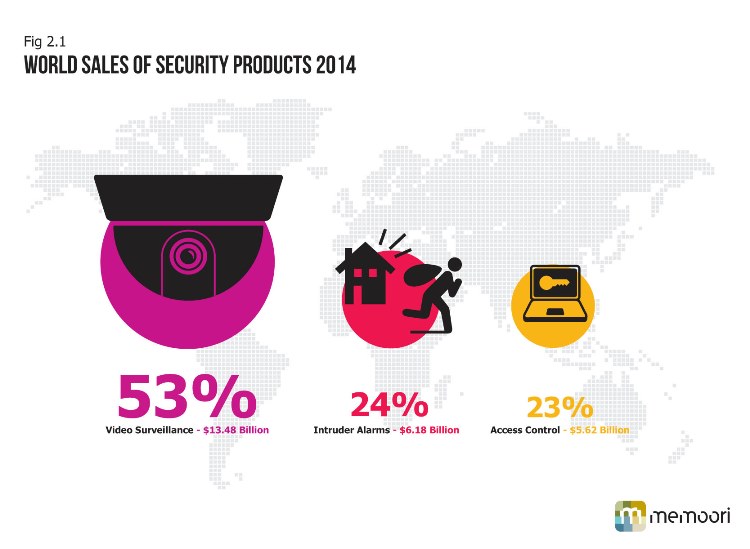

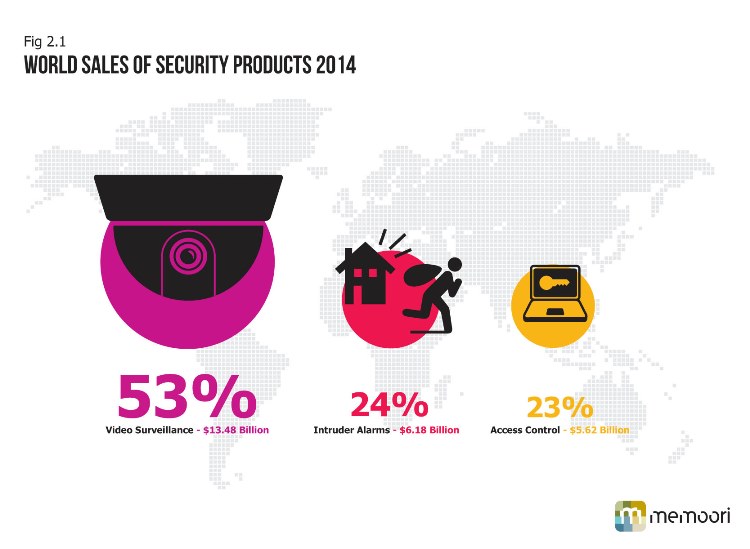

Our new research report is a complete assessment of Video Surveillance,

Access Control & Intruder Alarms markets in 2014; and also analyses

growth to 2018 –

http://www.memoori.com/portfolio/physical-security-business-2014-2018-access-control-intruder-alarms-video-surveillance/

The focused specialist players have spent heavily on their product

development programs and are now reaping the benefits of increased

market share and this is one of the main reasons why the security

industry has come out of the recession earlier and in a much better

shape than most other industries.

The physical

security industry in the first half of 2014 has well

outperformed what most stakeholders had forecast; despite setbacks in

economic fortunes in the western developed world the business has grown

by 40% from its decline in 2009. In the last 12 months it has grown by

7.5% and we expect this to continue for the rest of the year.

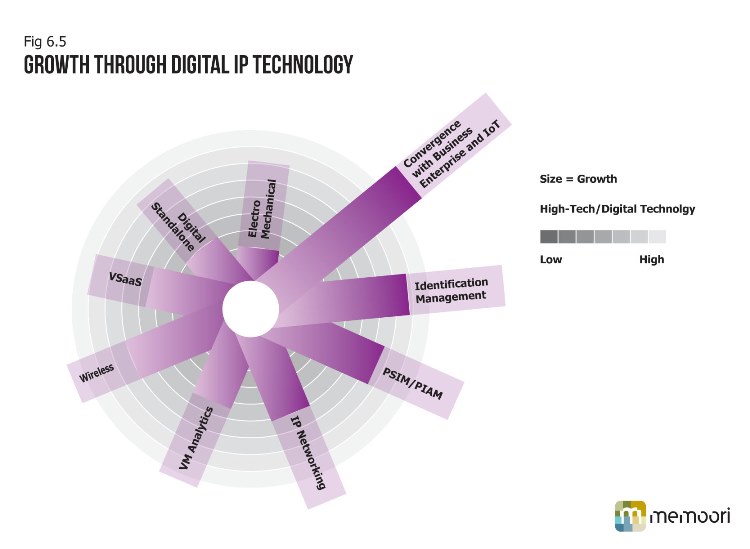

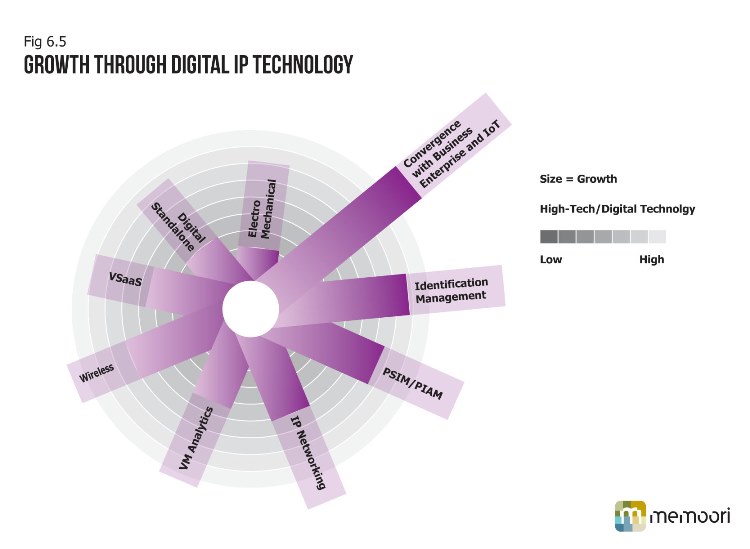

This steady consistent growth since 2011

has been driven by a

combination of factors including strong growth in IP Video Networking

and IP Access Control products, buoyant markets in Asia and North

America and higher levels of penetration in vertical markets such as

transport, retail, health and education.

Access Control Moves to IP and

Delivers Customer Value Propositions

Access Control, for so long the poor

relative of Video Surveillance,

this year has come out of the shadows and upstaged it by delivering

a higher growth rate and we forecast that it will continue to increase

its growth rate over the next five years.

This will be achieved by moving to IP Technology and integrating Access

Control with Identity Management. There can be no doubt about the

business case for integrating these services. Identity Management for

the purpose of Access Control has given rise to a number of major

acquisitions in the last five years. September 2010 saw a flurry of

activity with the purchase of L-1 Identity Solutions by Safran for $1.1

billion, 3M’s purchase of Cogent Systems for $430m, the merger of

AuthenTec and UPEK. In 2014 whilst the number of deals declined, this

group accounted for 19.2% of the total number of acquisitions and 5.6%

of the total value.

Access control through a standard card reader system is a weakness

particularly at a time when risk of corporate theft, malicious damage

to staff and property and terrorism has increased. The need for a more

secure system incorporating biometric devices to authenticate identity

and manage the process is becoming a standard requirement for new

systems in high security areas.

Physical Identity and Access Management (PIAM) is also a service that

promises to deliver further growth opportunities. It enables common

policy, workflow, approval, compliance automation and life cycle

management of the identity / badge holder (employee, contractor,

visitor, temps) across disparate physical security systems. The key

benefit from PIAM solutions is operational cost reductions that can be

delivered through this platform providing a bridge between the

disparate systems, without stripping out and starting again. PIAM has

so far failed to attract the mainstream PACS business.

There is a steady stream of alliances and partnerships between PIAM

Software companies & PACS companies but so far we have not

identified any mergers and acquisitions. Information on the business is

pretty sparse and most “best estimates” on the market size range around

$150 million. This if accurate is quite small, considering that

virtually all Fortunes Top 500 companies must have installed one.

Improved Performance, ROI &

Reduced TCO

[an error occurred while processing this directive]

Now has to be the time to dig even deeper and for manufacturers to

increase their efforts to align the motivation of security buyers to

invest in better performing systems through educating and training both

themselves and those in the distribution channel in order to drive out

all the benefits.

Whilst technology has been the enabler of change, the driver and

motivator is now clearly to channel this to deliver products and

services that increase productivity and provide a better ROI and reduce

the TCO. This is gradually changing the buyer’s culture from believing

that physical security is a pure cost center to a profit center.

Security, sadly, is still regarded by most end users as a cost center

and as such has been towards the end of the food chain for capital

investment. This can be crucial when budget reductions are on the

agenda. However a gradual change in attitude by buyers is taking place.

Specifically that security can be a cost saver when reducing shrinkage

(retail) and that when integrated with other services it can increase

productivity in the business enterprise and therefore reduce

operational costs. This has been made possible through IP convergence

and in some vertical markets such as retail there is a growing belief

that IP Video Surveillance should be treated as a profit center.

This has had a major impact on

increasing the value-add on security

projects. The market has not been slow to see the opportunities and

changing requirements for more converged and integrated solutions. In

order for companies to deliver such systems many have decided that it

is necessary to acquire, merge or form alliances and partnerships with

other suppliers. In order to maximize the opportunities of delivering

on ROI it is vital for suppliers to have specialist knowledge and

experience in vertical markets. But equally important is to have the

networking skills to join all the vertical and horizontal layers of

product together with the analytical software and interface with the

other building services software and finally join them to the business

enterprise. Video Surveillance is already on route to establishing an

important role in the Building Internet of Things ( BIoT) and the wider

IoT.

This has had a major impact on

increasing the value-add on security

projects. The market has not been slow to see the opportunities and

changing requirements for more converged and integrated solutions. In

order for companies to deliver such systems many have decided that it

is necessary to acquire, merge or form alliances and partnerships with

other suppliers. In order to maximize the opportunities of delivering

on ROI it is vital for suppliers to have specialist knowledge and

experience in vertical markets. But equally important is to have the

networking skills to join all the vertical and horizontal layers of

product together with the analytical software and interface with the

other building services software and finally join them to the business

enterprise. Video Surveillance is already on route to establishing an

important role in the Building Internet of Things ( BIoT) and the wider

IoT.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]

This has had a major impact on

increasing the value-add on security

projects. The market has not been slow to see the opportunities and

changing requirements for more converged and integrated solutions. In

order for companies to deliver such systems many have decided that it

is necessary to acquire, merge or form alliances and partnerships with

other suppliers. In order to maximize the opportunities of delivering

on ROI it is vital for suppliers to have specialist knowledge and

experience in vertical markets. But equally important is to have the

networking skills to join all the vertical and horizontal layers of

product together with the analytical software and interface with the

other building services software and finally join them to the business

enterprise. Video Surveillance is already on route to establishing an

important role in the Building Internet of Things ( BIoT) and the wider

IoT.

This has had a major impact on

increasing the value-add on security

projects. The market has not been slow to see the opportunities and

changing requirements for more converged and integrated solutions. In

order for companies to deliver such systems many have decided that it

is necessary to acquire, merge or form alliances and partnerships with

other suppliers. In order to maximize the opportunities of delivering

on ROI it is vital for suppliers to have specialist knowledge and

experience in vertical markets. But equally important is to have the

networking skills to join all the vertical and horizontal layers of

product together with the analytical software and interface with the

other building services software and finally join them to the business

enterprise. Video Surveillance is already on route to establishing an

important role in the Building Internet of Things ( BIoT) and the wider

IoT.