|

March 2018

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

|

Shaking Value Chains and

Channeling New Voices in BAS

What are 15+ IoT partner value chains trying to conjure up? They want

Cortana, Alexa or Siri in our walls telling us everything that needs

attention in our buildings.

|

Therese Sullivan, Therese Sullivan,

Principal,

|

John Leech [CC0], via Wikimedia Commons

Charles Dickens

was right. One of the best ways to tell a story is to

channel different voices for past, present and future perspectives. For

this telling, I’m casting those in building automation hoping for

business-as-usual in the role of Ebenezer and the physical security

industry as Jacob Marley’s ghost. This time, Marley isn’t in chains.

Rather, he is pointing out that, once building operational data is

moved to IP networks, there are no chains on alternate sales channels

into C-suites where decisions about buildings are made.

I was briefed on the history of how data architectures for physical

security systems evolved when I met Brad Kult, Associate Vice President & Director

of Technology Design Services, HGA Architects and Engineers, in January

at the AHR Expo Education sessions. Brad explained it

this way:

“Why did

Physical Security Transition to IP networking? Market pressure came

from fierce competition in CCTV cameras and other system components

that drove the industry to commodity pricing for IP-based hardware,

eventually away from expensive proprietary head-ends. Once all

of the hardware supported standard IP connectivity, systems were no

longer closed and new integration opportunities opened up. As for

software, that underwent a major transition too. Classic video matrix

switches began to be replaced by virtual matrix software using the IP

network to provide aggregation and transmission of video from cameras

and recording platforms.”

Brad was quick to see other similarities that will drive BAS solution

vendors and systems integrators along a similar path:

“Just as BAS

applications and analytics are being pushed to edge controllers,

analytics moved into cameras and access control devices. Low-cost

computing power and miniaturization allowed affordable cameras with

better thermal management, solid-state storage and lots of memory.

Likewise, because access control is subject to issues like transaction

latency, buffering in the controller, operating through power and

network outages. As soon as access control devices could be built with

the right compute resources, analytics moved to the edge.”

Brad Kult’s description of past dynamics in physical security jibed

with a January post on the Physical Security business by

Memoori Research. I recommend that you read the whole post; but, here

are the key points from the market analysis:

“Virtually all

the security, safety and environmental controls in smart buildings now

operate through IP Networks and this makes connectivity between them

much more practical, but it still needs a common communication protocol

to be used to enable data to be transferred and understood…[Once we

have] the final link in this chain... [we can] join all the devices on

a two directional network that can operate without human

intervention... that we can call a Building Internet of Things (BIoT).

“We have

almost reached the point where the technology to deliver BIoT solutions

is in place but the channels to market need to be developed...There is

now sufficient evidence to show that growth is not being limited by

demand but is being restricted by limitations in the capability of the

supply chain to deliver and service reliable systems…”

The real Jacob-Marley chain shaking part of this Memoori piece is in

this paragraph:

“The main

route to market for total solutions is at present direct to the end

user or his consultant but Systems Integrators (SI) are now active in

promoting this business and this has opened up a second channel. In the

US some of the Major SI’s have now got involved in the design and

installations of not just physical security systems but further

integrating environmental controls and lighting.”

As Memoori reports, the major IT SI’s have extended their businesses to

include physical security services and audio-visual services as a

natural outcome of IT Convergence, and they are quickly moving into

lighting. A case in point is this recent press announcement from a division of IT SI

major Tech Data detailing an extended partnership with Crestron

Electronics for Microsoft Skype-powered conference-room AV equipment.

Crestron is also a major brand of lighting control and other office

building automation systems, so the opportunities to extend this

partnership to other IoT or as-a-service solutions are many.

For the voice of IT Convergence Future, you can hear an expert on

enterprise IT channel selling on a recent ControlTalk podcast. Rauline Ochs of the Channel

Company sees IT and Operational partners teaming together to bring

new aggregated IoT solutions to market. She describes their playbook

like this:

“Starting with

expertise in edge devices and vertical industry domain knowledge, some

OT companies will move to deliver control units to their customers.

From control, they will move to IoT platforms, so that they can get

involved in analytics. If they can succeed with customers on the basis

of superior analytics - delivering high value from connected things,

extracting insights, impelling action - they can control the customer

ROI. If they control the ROI, they control the sale and are higher in

the value chain among many partners.”

I glimpsed just how close the buildings world is to this future when I

went to the Microsoft IoT in Action Conference in San

Francisco in mid-February. Primarily the event showcased the Microsoft

Azure IoT platform and new AI tools. But, far and away, the most

information-rich session of the day was the industry panel featuring

some of the major IT SI’s using the Azure platform and tools.

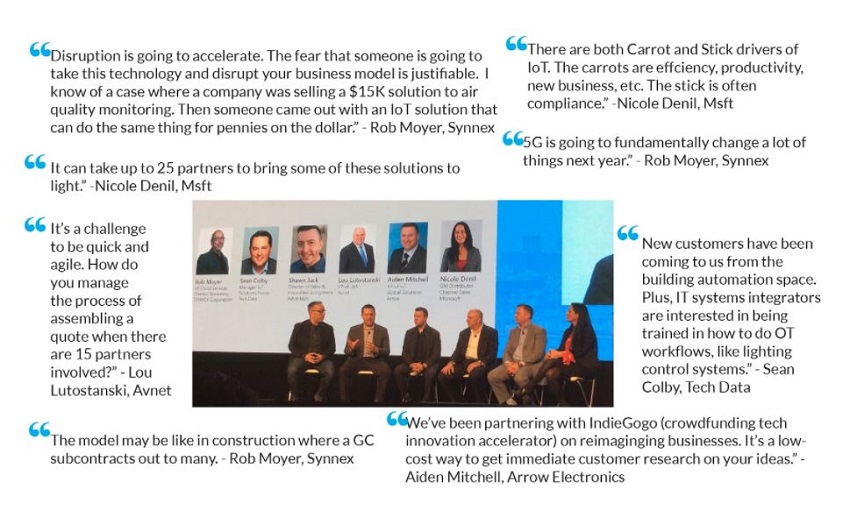

This panel was moderated by Nicole Denil, Microsoft’s GM of the

Aggregator Channel, and included IoT leaders from Arrow Electronics,

Tech Data, Synnex, Avnet and Advantech. The IoT deployments they

described were right out of the Playbook described by Rauline Ochs of

Channel Company. Here are some of the stand-out quotes from this panel.

The session on IoT Business Model Transformation featured a physical security company, Genetec.

The company's IoT leader, Christian Morin, detailed the process of

remaking a business to leverage IoT workflows. Genetec has established

a new brand for its cloud-based video monitoring system, Stratocast.

Here you can start to see all the ways it is forging a new route to

profitability - from hardware margin to subscription, from capex to

capex plus opex. Also, Morin talked to how the relationship to the

customer must change from transactional to a partner that is

sufficiently trusted to keep renewing the service. Some call that a Managed Service-type relationship.

The

comparison of physical security industry dynamics to BAS has its

limitations. To date, there has been no direct sales model for BAS

because of the skill set required to integrate HVAC designs unique to a

building involving equipment of competing brands. In BAS IoT, the major

value in the solution will still likely come from OT partners—like

energy and commissioning service contractors, mechanical contractors,

and controls contractors of various sizes, brands, and capabilities.

Though security systems can be complex, they are more self-contained

and thus have often been managed within the realm of a sophisticated IT

or internal services group. So it's no surprise that IT

Convergence has come to these workflows first. Still, BAS OT

partners can learn from the Genetec Business Model Transformation

story. They need a data road map and data playbook too. But, it is

their physical presence and ability to tend to the needs of a buildings

inner workings that position them for the Managed-Service relationship.

Microsoft

noted several times during the conference that it can take from 15 to

25 IT-expert and OT-expert partners to comprise a successful IoT

workflow. That is unprecedented. Today, the IT big-brands are

transparent about wanting only to offer the tooling —

infrastructure-as-a-service, platform-as-a service, big-data and

eventually AI tools. The major value in the solution will come from OT

partners. What are these 15+ IoT partner value chains trying to conjure

up? They are clear about that too; they want Cortana, Alexa or Siri in

our walls telling us everything that needs attention in our buildings.

To make it work, all partners need to be open and transparent in their

business practices and contributing technologies. As the big-brand

cloud providers compete, they are driving such tooling - even the AI

and voice components - to commodity status. Like Genetec, OT partners

can maintain their upper-hand position and own the customer

relationship, delivering the high-value managed service part of the

offering. That is, if they are awake to the industry transformation

underway. So it can be a happy ending for those building automation

solution providers and SIs who, like Ebenezer, wake up and seize

tomorrow.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]

Therese Sullivan,

Therese Sullivan,