What Happened? - Part 2

|

October 2012 |

[an error occurred while processing this directive] |

|

Energy Efficiency Cleantech

Solutions

What Happened? - Part 2 |

| Articles |

| Interviews |

| Releases |

| New Products |

| Reviews |

| [an error occurred while processing this directive] |

| Editorial |

| Events |

| Sponsors |

| Site Search |

| Newsletters |

| [an error occurred while processing this directive] |

| Archives |

| Past Issues |

| Home |

| Editors |

| eDucation |

| [an error occurred while processing this directive] |

| Training |

| Links |

| Software |

| Subscribe |

| [an error occurred while processing this directive] |

In our discussion last

month, Energy Efficiency Cleantech

Solutions - PART 1, we had the opportunity to explore some of the

leading constraints that influenced the decision-making process for

cleantech solutions. Using a similar approach as we did in the

first discussion, we asked 15+ producers

of technology-based solutions, “What

are

the top three issues or

objections you observe when attempting to

position an energy efficiency solution to a customer?”

Here in

Part 2 we will focus our attention on the top responses provided by

producers, then attempt to tie together what we hope will be a more

effective alignment of decision-making between buyers and

sellers.

The sample group of “producers” was comprised of cleantech software

companies, venture capital firms, established controls/hardware

manufacturers, utilities, integration companies, enterprise software

companies, and commissioning/services firms. Again, this was a

qualitative study not quantitative. As in the Part 1, we will not be

providing the names (all were at executive management level) of the

individuals we interviewed nor the organizations they represent. The

discussions that were conducted were completely off the record.

If we reflect back to the leading issues or constraints that consumers

provided us last month, you’ll see some interesting parallels surface

throughout our discussion. Here were the top seven issues that

consumers identified from our Part 1 discussion:

|

|

|

|

|

|

|

Prior to listing

out what thought were the most recurring issues

impacting the sales cycle in our industry (specifically). It is

important to acknowledge that virtually ALL interviewed felt that the

following issues were playing a role in the apparent slow down in

consumer decision-making as it relates to cleantech solution adoption.

Coupled with the leading seven issues producers observed impacting consumer decision-making, you can see how the sales cycle for cleantech solution adoption would typically be over 12 months (according to producers) in this climate. Here are the top seven issues producers identified:

|

|

|

|

|

|

|

For most cleantech solutions to be

effective in surfacing their

proposed value, there typically needs to be a “newer” building

automation/management system in place, as well as some type of network

and protocol interface to gain access to all the relevant data to be

analyzed from a particular facility. In addition, a knowledgeable and

experienced staff is often relied upon for successful adoption as well.

Although in some instances this is indeed the case, however, in the

vast

majority of facilities this is not an easy task to realize.

Antiquated BMSs that are configured improperly, closed controls’

protocols, asset-naming conventions that don’t match up, numerous

sensors that don’t work (just to name a few), seem to be more of the

norm says the majority of producers.

An old colleague of mine

would always say, “buildings are like a box of

chocolates, you never know what you’re going to get.” In other words,

extreme variances make normalizing data inputs a challenge for

“leading-edge” cleantech software solutions. According to producers,

technology has outpaced a market whose systems are significantly more

antiquated, when compared to their IT counterparts.

As in the case of consumers, producers would prefer to work with

talented customer teams, who understand where the market is trending,

and who have staffed accordingly. A mismatch between ill prepared

consumers with a demanding cleantech integration requirement

(technology and people) can really slow the process down for adoption.

[an error occurred while processing this directive]To

complicate matters more, producers identified experiences in which

the consumer has been fearful of cleantech solutions. This could be a

fear that the “new technology’ could expose facility-based problems

that cause embarrassment for the decision-maker or possibly a

maintenance staff that may circumvent the cleantech solution for fear

of being displaced. There’s also a recognized fear of betting on a

cleantech solution that has been “over sold” with unreachable promises

(20%-30% SAVINGS!!), and then the fear of being the

decision-maker, who

pays the consequences for the making the wrong decision.

As so often is the case, mitigating risk is a critical component in the

decision-making process. One of the key tools IT used to mitigate

risk was commercial validation in the form of comprehensive case

studies, in which similar companies realized the business value

associated with the adoption of leading-edge solutions. As you

may recall, consumers were also desperately looking for verification

that cleantech solutions have been successful in surfacing results in

other deployments. Obviously, the impact a case study can have on

the decision making process varies from consumer to consumer.

Nevertheless, we can’t overlook the fact that our industry has very few

publically available “detailed” success stories in which to project a

potential outcome on.

The cumulative effect of these

“buying obstacles” can be difficult for

“procurement” to get “their arms around as well.” According to many of

the cleantech producers I spoke with, a sizable amount of their deals

slow or even die at this point in the process. Why is that the case?

Maybe, the answer lies in the box of chocolates? “You never know what

you’re going to get.” If that is the point that we are left with, then

what is the purpose of this 2 part series? What do we hope to gain from

exploring the obstacles and the issues that both consumers and

producers face when attempting to do business?

As a final step, let’s take a look at the most recurring shared

“issues,” and see if we can make some suggestions that may help the

decision-making process for both consumers and producers.

First, let’s address the current

“universal market constraints” of the

election, economy, and decreased cleantech incentives. Face it; we

can’t impact these market issues, we can only factor them into our

approach. So, we move on!

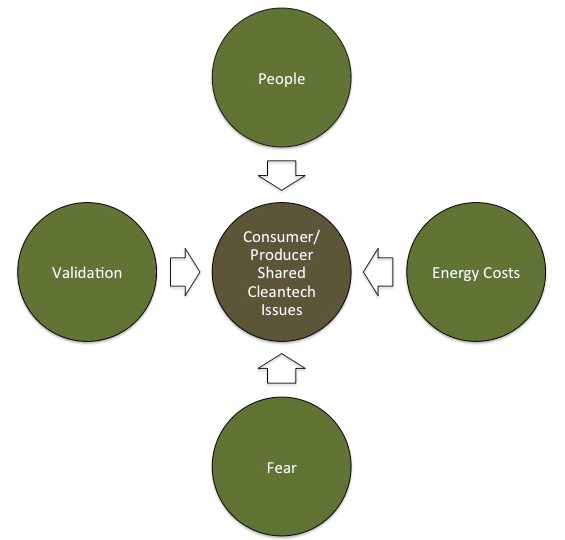

People, fear, validation, and energy costs represent a classic pattern

in response to inevitable change. For the past several years, we

have experienced a desire to innovate one of the last bastions in the

enterprise, the “facility business.” The infusion of investment monies

spurring cleantech solution development, a green revolution advocating

sustainability and energy efficiency, corporate PR motives, new job

requirements and skills, retrofits, and many more “disruptive”

circumstances in which our industry has had to face, have forced us to

adapt to these changes faster than any other segment of the market. The

net effect has only made us stronger as a result.

When faced with uncertainty, fight, flight or freeze are

typically the

responses to fear. Hopefully, by knowing this we can all empathize with

stakeholders on both sides of the fence, thereby working to raise the

level of understanding each of our “mutual” needs to succeed when

making the right decision. Empathy appears to be a very common thread

that both producers and consumers share. When asked about empathy, the

overwhelming response on both fronts was to use this awareness when

aligning needs with a solution. The result: both sides win.

We know that eventually cleantech solutions will move from its current

“early adoption” phase to a mature industry. One could predict with

great accuracy that valid cleantech results/impact will be readily

available in the form of case studies and testimonial support in the

near future. What this industry needs is repeatable success. Both

consumers and producers suggest that this will lead to less risk up and

down the decision-making process. From IT to procurement, and then

eventually the c-suite, we will witness far less uncertainty and far

less fear.

As successful adoptions of cleantech solutions become the standard,

we’ll most likely see additional investment dollars pumped in to the

industry to stimulate further innovation, growth, and “convergence.”

According to many that were interviewed, this will intensify the

interdependence of IT and facilities, thus creating an inseparable bond

(people, process, technology) that will lead to a transformation in our

industry.

Even though much of what we discussed and emphasized as constraints

that impacted the adoption of cleantech solutions could be perceived as

negative, I don’t look at the state of our industry in such a way.

Rather, I think getting the issues out to debate is the best way to

shape an industry which has yet to fully mature. I for one am very

encouraged about what the future has in store for cleantech.

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The Automator] [About] [Subscribe ] [Contact Us]