April 2009

![]()

AutomatedBuildings.com

[an error occurred while processing this directive]

(Click Message to Learn More)

April 2009 |

[an error occurred while processing this directive] |

|

Some Thoughts on GridEcon 2009 This is the first conference to bring together practitioners in energy markets, business, policy, interoperation technologies, building automation, venture capital, and related areas. |

GridEcon 2009 took place in Chicago on March 16 and 17th. This is the first conference to bring together practitioners in energy markets, business, policy, interoperation technologies, building automation, venture capital, and related areas.

|

|

|

|

|

|

|

|

|

|

|

|

|

[an error occurred while processing this directive] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[an error occurred while processing this directive] |

The web site (http://www.GridEcon.com) has PDFs of most of the presentations; the purpose of this note is to talk about some of the interesting things that happened there rather than a recitation of the talks and speakers. I’ll write briefly about three sessions and a meeting on pricing models and information exchange.

Dynamic pricing is key to achieving the peak reduction and capital investment goals of the Smart Grid. The two sessions, Dynamic Pricing Market Architecture and the following Value of Dynamic Pricing, showed a variety of approaches, but no argument about the importance.

Dynamic pricing (sometimes called real time pricing) is well understood (and used) in the Commercial and Industrial markets, but dynamic pricing is only slowly moving in to residential markets. There are many articles, blog posts, and presentations on dynamic pricing (see, for example, Roger Levy’s summary slides from GridEcon and Lynne Kiesling’s posts at KnowledgeProblem.com).

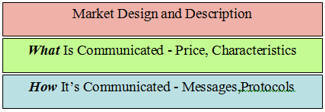

Prices

have meaning within markets; it’s a challenge to define price in a way that

doesn’t carry an implicit meaning along with it. Price version 1.0 is usually a

number, usually including a decimal fraction, but without indication of what

unit is bought or sold. Interoperation protocols, such as

OpenADR (with the interoperation and protocol aspects being standardized in

the

OASIS

Energy Interoperation Technical Committee, in formation) are the foundation

(see diagram).

Prices

have meaning within markets; it’s a challenge to define price in a way that

doesn’t carry an implicit meaning along with it. Price version 1.0 is usually a

number, usually including a decimal fraction, but without indication of what

unit is bought or sold. Interoperation protocols, such as

OpenADR (with the interoperation and protocol aspects being standardized in

the

OASIS

Energy Interoperation Technical Committee, in formation) are the foundation

(see diagram).

The two sessions on carbon trading, Anticipating Carbon Markets and Smart Grid and the Carbon Market addressed the effects of energy characteristics and how the Smart Grid could deal with carbon trading or taxes. I participated in the second session only.

I learned some of the jargon and complexity of carbon trading (cap and trade). The most confusing to me was the concept of additionality—you don’t get carbon credits (with financial value) for things you “would have done anyway.” I still don’t understand how one can make prospective economic choices in a hypothetical carbon market when the cost of your choices is determined after you make them. How can you separate what you would have done in the absence of carbon markets from what you did in the presence of carbon markets? That would argue for known-in-advance taxes or fees, hence factored into purchase decisions; those, of course, create a different set of problems.

The good news is that the characteristics of energy can be bundled with price and purchase decisions to make decisions and use more transparent; see my presentation. The cryptic reference to Jamaican Blue Mountain Coffee and renewable energy comes from the discovery some years ago that the production of expensive Jamaican Blue Mountain Coffee was a small fraction of the amount sold; is there a parallel in un-auditable energy transactions?

Parts of the carbon market session relates to some fascinating discussion in another session, New Investment Opportunities in Smart Grid led by Carter Williams of OI Ventures. One panelist, when asked how venture capitalists evaluate businesses, said (paraphrased) that you look at the business without the possibly temporary tax and other incentives. I wonder how they would value the carbon trading approaches?

There was a great deal to learn from the keynotes. Selected keynotes (Ed Cazalet’s on Dynamic Forward Pricing, and Bradford Leach’s on CME Group Electricity Markets) are on line; for the rest you had to be there.

There was an evening informal session on pricing; some fifteen people participated. The discussions were around price, how you communicate price, and related issues. An interesting range of participants were there, from people working for cell phone companies (there may be applicable protocols used for prepaid cell phones today that would work for “roaming” plug-in electric vehicles) to people who structure forward, or futures, markets for energy to people who appreciate the clear communication of prices.

There are many different energy markets in the United States alone; they have different formats and meanings for price, which makes the job of someone creating price-aware building automation systems difficult—one price model doesn’t work in the next jurisdiction.

There’s a Technical Committee in formation that will create an XML vocabulary for communicating prices and characteristics; here is an email with a current draft charter.

GridEcon 2009 was an intense and interesting conference. There was plenty to argue about, and a great deal to learn. And as with most conferences, the most valuable discussions took place during breaks and receptions.

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The Automator] [About] [Subscribe ] [Contact Us]