|

July 2013

Interview

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

EMAIL

INTERVIEW

– Tom Shircliff, Rob Murchison and Ken Sinclair

Tom

Shircliff and Rob Murchison are the principals of Intelligent

Buildings, LLC,

a smart real estate professional services company that they co-founded

in 2004. Intelligent Buildings provides planning and implementation

management of next generation strategy for new buildings, existing

portfolio optimization and smart community projects. Intelligent

Buildings has worked extensively throughout North America in over 50

different cities.

Tom

Shircliff and Rob Murchison are the principals of Intelligent

Buildings, LLC,

a smart real estate professional services company that they co-founded

in 2004. Intelligent Buildings provides planning and implementation

management of next generation strategy for new buildings, existing

portfolio optimization and smart community projects. Intelligent

Buildings has worked extensively throughout North America in over 50

different cities.

Tom and Rob have been recognized for numerous industry firsts including

lead consulting on "The Smartest Building in America", conception and

development of a Clinton Global Initiative public private partnership,

development and program management for the largest building energy

analytics project in the North America and creation of federal smart

building standards. Additionally, they have been name one of “35 to

watch” in the industry.

They

also help shape the industry through collaboration, advisory and

lecturing at national laboratories and universities including Lawrence

Berkeley National Laboratories, Pacific Northwest National

Laboratories, Harvard University Graduate School of Design, Wake Forest

University School of Business, UNC Charlotte and Georgia Tech

University College of Architecture.

Organizing the Energy Analytics Marketplace

Customers say they were indeed getting dizzy

from all the vendor

messaging and pitches and this helps frame the

marketplace.

Sinclair:

The energy analytics industry has

been growing rapidly which has spawned a number of different types of

companies and solutions. Does your company track the ongoing

developments in this industry segment?

IntelligentBuildingsŪ:

We do have to track the industry for our customers in order to provide

the best guidance for them. However, our research is not just an

exercise or theoretical opining. While we are engaged to provide a

“state of the industry” report, more often we are helping a portfolio

owner to get to an actual solution implementation with quantifiable

results.

Sinclair:

OK, but to provide an actual

solution, isn’t that a matter of

referring to your latest research to see who is best at the time of

your recommendation?

IntelligentBuildingsŪ:

We used to think so but things have changed quite a bit recently. Just

a few years ago it was in fact a matter of “who is best” since there

were relatively few options and you could make real progress by just

picking the best of the lot. Now there are many more options and still

more legacy companies evolving or rebranding themselves as “energy

analytics”. This has created noise in the marketplace and some

confusion among buildings owners/managers because they were frequently

comparing apples to oranges. We determined that it was necessary

to categorize the different types of offerings.

Sinclair:

That makes sense, but did you

find logical categories and to what end?

IntelligentBuildingsŪ:

We did indeed find logical categories. Although it is important to note

that this was born from a customer perspective, not a solution provider

perspective. In other words, when working with the end in mind, we have

to consider the building owner/manager knowledge, resources, property

management processes and aims for analytics. Thus, when we grouped the

service providers we then began a process for matching the customer

profile to the solution provider profile. That is the goal of this… to

match the customer profile with service provider profiles and then only

evaluate those solution companies that are a categorical match.

Sinclair:

So, what are the segments or

groups and how does it work?

IntelligentBuildingsŪ:

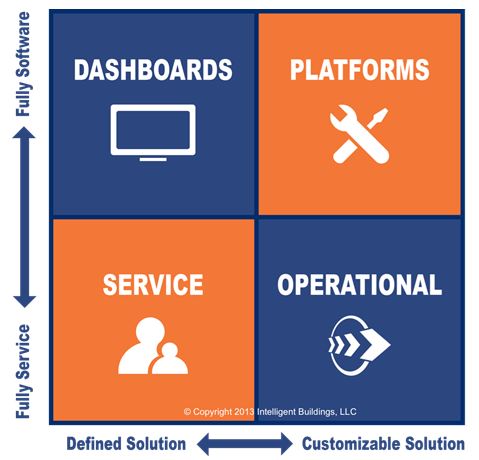

We found

four main solution types in the

marketplace that were influenced by two characteristic spectrums.

The characteristics were simply

- the degree of software dependency and

- the degree of customization.

So, on the y-axis we created the range

of software vs people centric

solutions. On the x-axis we created the range for defined vs.

customizable solutions. We then labeled the quadrants with the four

solution types we discovered:

- Dashboards

– – Energy dashboards that track real time usage and trends and then

derive analytical insights from that information. This approach is

faster to implement and less involved with operational change.

- Platforms

– More traditional software purchases that require licensing, hosting

and some capability to manage the data gathering, interpretation and

action plan. A third party integrator may often accompany these

solutions. This is more of a strategy ownership approach and seeks to

change operational processes.

- Services

– People centered services that have a high touch approach that often

includes at least monthly calls do discuss data interpretation; action

plans and follow up on previous calls. This is more of an outsourcing

method when internal resource constraints may be present.

- Operational

– These solutions access and optimize the actual building systems

operational configuration, sequences of operations and routines and

seek to optimize them strategically and automatically.

Sinclair:

What has the reaction been from

building owners/managers and

the solution providers?

IntelligentBuildingsŪ:

Its been fantastic. We have talked to dozens of each and the customers

say they were indeed getting dizzy from all the vendor messaging and

pitches and this helps frame the marketplace - but more importantly

helps them think about themselves and what type of solution they should

be looking for. As to the solution providers, we did not approach this

as merely as our educated opinion. Rather we sent out an extensive

survey to dozens of providers and then talked with them on the phone or

in person to get agreement on the rationale for their position in the

quadrants. They realized that this is not a rating system (which can

come later during a proper evaluation for individual customers), that

no quadrant was necessarily better than another and that it actually

serves them well not to spend a lot of sales time on a mismatched

opportunity.

[an error occurred while processing this directive]Sinclair:

Where have you put the word out

about this?

IntelligentBuildingsŪ:

We

announced this at Realcomm / IBcon in

Orlando and had a full three days with the industry to discuss it and

get feedback. We were very grateful to do it there and to get such an

enthusiastic reaction from all corners. We talked a lot about analytics

during our “Conference Live” interview at IBcon but also in an

interview with “Control

Talk Now Live”.

We are using the quadrants and our step

by step measured, methodology on a daily basis with our customers but

we feel good that this will also help the industry and the adoption

rate of energy analytics overall. This is a powerful low-cost,

high-value solution that is right for the times.

Sinclair:

What else is Intelligent

Buildings up to in the marketplace?

IntelligentBuildingsŪ:

We are spending a lot of time on analytics in the commercial,

corporate, healthcare and government spaces but we are also working on

some iconic, new development projects that are leveraging our

convergence experience during the design-development process and we

continue to be active in the smart community segment, building on the

success of

Envision Charlotte which is a Clinton Global

Initiative that connected 22 million square feet and 65 buildings in

urban Charlotte, NC.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]

Tom

Shircliff and Rob Murchison are the principals of Intelligent

Buildings, LLC,

a smart real estate professional services company that they co-founded

in 2004. Intelligent Buildings provides planning and implementation

management of next generation strategy for new buildings, existing

portfolio optimization and smart community projects. Intelligent

Buildings has worked extensively throughout North America in over 50

different cities.

Tom

Shircliff and Rob Murchison are the principals of Intelligent

Buildings, LLC,

a smart real estate professional services company that they co-founded

in 2004. Intelligent Buildings provides planning and implementation

management of next generation strategy for new buildings, existing

portfolio optimization and smart community projects. Intelligent

Buildings has worked extensively throughout North America in over 50

different cities.