July 2009

![]()

AutomatedBuildings.com

[an error occurred while processing this directive]

(Click Message to Learn More)

July 2009 |

[an error occurred while processing this directive] |

|

“The Dawn of Convergence …. Or the Eve of Collision?” Another Commentary on BAS-IT Convergence |

President

|

In my column last month I made the point that the walls historically erected between the Information Technology and Facility Management domains serve both communities well, though perhaps for different reasons. Even so, there are significant industry trends driving the two domains closer together and chipping away at the walls. A popular moniker for this evolution is “convergence,” which could bring to mind Cairo, Illinois where the Ohio and Mississippi rivers come majestically together around a gentle curve. Or the word convergence could bring to mind the geometric precision of the freeway cloverleaf where I-77 joins Highway 421 outside Winston-Salem, North Carolina. And those may be fine analogies for a future that is already edging into the present. But, I think an equally likely analogy could be drawn from the 1951 movie, “When Worlds Collide.”

|

|

|

|

|

|

|

|

|

|

|

|

|

[an error occurred while processing this directive] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[an error occurred while processing this directive] |

BAS Industry Evolution

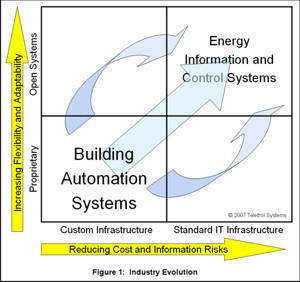

BAS systems have evolved dramatically as they leveraged Moore’s law over the last couple of decades. The lower left quadrant of Figure 1 reflects key characteristics of BAS systems developed in the late 1980’s and through most of the 1990’s. Developers were focused on “automated buildings” that used embedded computers to do the same things that people did, but with greater precision and consistency. To accomplish that goal, automation was necessarily built on proprietary technologies and custom network infrastructure.

Over the last decade or so, the growing importance

of information relating to buildings and energy use resulted in new system

requirements for reducing the cost and risks associated with gathering,

communicating and storing BAS-related information. In response, system designers

have turned to the existing IT infrastructure as the most cost-effective way to

meet those requirements. At the same time, an increasingly dynamic regulatory

environment and “Internet-driven” changes in user expectations have resulted in

a new requirement for systems to be much more flexible and extensible. BAS

designers are learning to address those requirements through the incorporation

of standards and the adoption of open systems models. Combining an open systems

model with standard IT infrastructure allows developers to go beyond far BAS. As

represented in the upper right quadrant of figure 1, the opportunity now exists

for the development and deployment of Energy Information and Control Systems.

Energy Information and Control Systems combine the functions of traditional BAS

solutions with extensive connectivity, data collection, analytics, reporting and

information integration capabilities. As a result, they provide more value in

the short term and offer more opportunities for innovation in the long term.

Lower left to Upper right

At

first glance it might seem that moving from the lower left quadrant to the upper

right quadrant in Figure 1 is primarily a matter of navigating a series of

technology shifts … perhaps as conceptually simple as replacing proprietary

device-level networks and protocols with standards (e.g. BACnet) and utilizing

the IT infrastructure for information management. With careful attention to

backward compatibility these shifts can be accomplished with minimal disruption

to user-supplier relationships, business models and value chains. And if indeed

that’s all it takes then the “gentle” convergence analogies are fine. But there

may be more to it than that. We might find that the technical evolution involved

in aligning the BAS and IT worlds is the easy part. Aligning their respective

business models and supply chains might be more challenging … and perhaps more

disruptive that most people might imagine.

At

first glance it might seem that moving from the lower left quadrant to the upper

right quadrant in Figure 1 is primarily a matter of navigating a series of

technology shifts … perhaps as conceptually simple as replacing proprietary

device-level networks and protocols with standards (e.g. BACnet) and utilizing

the IT infrastructure for information management. With careful attention to

backward compatibility these shifts can be accomplished with minimal disruption

to user-supplier relationships, business models and value chains. And if indeed

that’s all it takes then the “gentle” convergence analogies are fine. But there

may be more to it than that. We might find that the technical evolution involved

in aligning the BAS and IT worlds is the easy part. Aligning their respective

business models and supply chains might be more challenging … and perhaps more

disruptive that most people might imagine.

The respective value chains of energy management systems and traditional IT

systems are similar in many respects but largely separate. Both involve

substantial design services, embedded computing, physical field installation,

communication networks, system commissioning and ongoing support services. Even

so, the value chains tend to operate differently and there are very few

organizations that serve both markets at any point in the value chain. They are

almost like parallel universes. The IT industry has evolved into a collection of

“best in class” suppliers whose system components all work together across

standard interfaces. Leading suppliers (CISCO, IBM, Microsoft, Dell, Intel,

Oracle, etc.) tend to focus on doing certain system components well and leaving

other components to implicit or explicit industry partners. As a result, you

would be surprised to find an IT environment where most of the hardware

(servers, routers, PCs, etc) software (operating system, database, applications,

etc) and services (design, installation, support) are all from the same company.

Yet, in energy management systems, finding a single supplier for all (or the

majority) of the components required for a total solution is not so uncommon.

It’s unlikely the IT industry will reverse decades of movement toward open

systems so convergence is likely to mean the BAS industry will have to adopt

business models consistent with the IT industry … best in class component

solutions that integrate around industry standards.

Contrasting Strategies

So, how exactly is that going to happen? What choices will various companies

make in that process and how will they compete with each other as the industry

evolves? To me, these convergence questions are even more intriguing than the

technology questions. There is no doubt that the growing ubiquity of standard

interfaces (e.g. BACnet, web services, etc) will create new opportunities for

companies that decide to focus on one or a few components in the overall

solution and become “best in class.” It’s equally clear that this opportunity

extends beyond existing companies to anyone who has a bit of entrepreneurial

zeal and expertise in some aspect of building automation or energy management.

But, how will they compete with companies whose business strategy is to provide

the “whole” solution? How do each of them they play in the future of our

industry?

As we look to the future of our industry and consider Energy Information and

Control Systems, it’s hard to imagine a scenario where a single company truly

provides the “whole” solution. The “big” names in the IT world are unlikely to

become experts in the mechanical systems at the heart of HVAC or in the

subtleties of lighting and its impact on building occupant productivity. At the

same time, it’s hard to imagine a world where the suppliers of BAS and energy

management systems are experts in IT infrastructure components and solutions.

Yet, a “whole” solution clearly requires both … along with a host of other

component products and services. The fact that it will be hard for any company

to provide the whole solution may open the door for a broad range of specialty

suppliers. The list will no doubt include some of the usual suspects in HVAC,

lighting, security, life safety, and other traditional BAS domains. But open

technologies means the list will probably include companies that have not

traditionally participated in the BAS world, but have deep expertise in

analytical methods, visualization, data mining, diagnostics, thermodynamics and

other relevant domains. The pool of “best in class” component suppliers will

compete on many levels and include all kinds of companies … from billion-dollar

adjacent market suppliers to garage shops offering component solutions embedded

in Google gadgets or Yahoo widgets.

[an error occurred while processing this directive]

Another factor that makes the question of supplier breadth versus specialization

an interesting one is the rapidly increasing scope of the “solution.” It will

not be enough to address monitoring and control of energy consuming devices, or

even of managing the information associated with them. Instead, the entire

energy lifecycle, including procurement, generation, conservation and

utilization will all be part of the energy information and control solution,

making it even harder for a company to be competitive across the full spectrum.

While it’s hard to imagine a single supplier offering the “whole solution,” it’s

virtually certain some users will want a single source for their solution. Some

users will want (and be willing to pay for) the simplicity and effectiveness of

a single supplier model. This suggests there will be a system integration

opportunity that is different from the traditional BAS or IT system integration.

It will require skills in both domains and a level of marketing and sales

sophistication to address the needs of multiple constituencies in user

organizations. This system integration domain may be one of the largest and

least understood opportunities in BAS-IT convergence.

When Worlds Collide

As we look forward to the full convergence of IT and BAS it seems clear that all

energy information and control system suppliers will adopt open technologies.

Even the largest and most proprietary suppliers are incorporating BACnet in

their system architectures if only because using BACnet is simply more

cost-effective than inventing a new solution. For the same reason, IT standards

for communications and application integration (e.g. Internet and web services)

will be incorporated in products from all suppliers. At that point, openness of

technology will not be a differentiator among mainstream suppliers and users.

However, adoption of open technologies does not automatically mean adoption of

open business models. Companies will have the option to focus on being “best in

class” for specific components and relying on an ecosystem of explicit and

implicit partners to supply other components. These ecosystems of suppliers will

compete with “all in one” suppliers who adopt a “single source” business model.

The resulting market dynamics and evolution in supplier market positions may

have more in common with colliding worlds than a freeway on-ramp.

As always, the views expressed in this column are mine

and do not necessarily reflect the position of BACnet International, Teletrol

Systems, ASHRAE, or any other organization. If you want to send comments to me

directly, feel free to email me at

andysview@arborcoast.com.

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The Automator] [About] [Subscribe ] [Contact Us]