|

Selling Integration and

Convergence Convergence

Will Happen

Why Is There A

Need For Marketing? As published in the |

AutomatedBuildings.com

|

[an error occurred while processing this directive] |

|

Selling Integration and

Convergence Convergence

Will Happen

Why Is There A

Need For Marketing? As published in the |

"…companies only exist for two reasons, to innovate and to create value."

-- Peter Drucker

The Buildings Industry is undergoing massive change, and its' impact on automation and engineered systems will be profound. My conservative estimate is that 75% of today's "control contractors" will cease to exist, or dramatically change their business model over the next decade.

In the spirit of Drucker's quote it seems that those who do not use the convergence of technologies underway to innovate and bring value should cease to exist. Don't turn the page yet however, because the focus here is not on selling systems, it is also on managers who struggle to demonstrate the value of new technologies to decision makers and must continuously justify their existence.

|

[an error occurred while processing this directive] |

If the above prediction is true, owners must ask … how will buying and managing building systems change due to convergence? The automation industry (which includes both early adopters who apply systems and organizations that drive the process through buying those systems) must move convergence forward. The focus here is on how to participate in the process.

why buyer's buy

The fundamental question is why would buyers buy convergence? Quite simply buyers will only buy convergence if there's a Return on Investment (ROI), and compelling business benefits. In the past Building Automation Systems (BAS) were discretionary purchases. During the 1980's and 1990's systems were common in large building new construction, but often limited to overlays of pneumatic controls.

Through the 1990's BAS became more common in buildings from 10,000 square feet up. The challenge became integrating systems in multiple buildings on campuses or in phases of building construction, which drove standard or open systems development.

Many still believe Integration only means making independent legacy systems talk to one another, but legacy integration does not answer the call to sell convergence. Selling convergence requires first understanding its nature and benefits, and more importantly how those benefits translate to value and buying decisions.

System value is often misunderstood as in converging security and automation. Recently CFO magazine stated that expected post-9/11 security technology spending never occurred. CFO said that this was because there is no ROI from buying security technology to avoid terrorism. This shows confusion between sellers and buyers on the technology's benefits. Security technology can protect facilities from terrorists, but facility managers don't think terrorist attacks are likely.

However, the real story in selling security is not anti-terrorism, but all the other benefits these systems offer. Equally important, these security systems are Internet protocol (IP) camera systems that treat video images as digital data, and can be integrated with Access and Building Automation for numerous shared sequences. To borrow an IT term, a killer app (application) is a tool that revolutionizes the way tasks are done, think of spreadsheet software. Digital Tripwires are great examples of technology convergence; these Security Killer Apps can be integrated with Video Surveillance, and eliminates archaic motion detectors by leveraging digital technology. IP enabled cameras stream video and digital tripwires, such as those shown above define secure areas. When one pixel changes in the cameras field of vision an alarm is tripped in real-time and notifies 24 / 7 alarm centers.

[an error occurred while processing this directive]So the technology is interesting, but why buy it? For the ROI, Tripwires help control risk of theft and vandalism, and are saving $100K+ per year in many facilities. Implementing this technology can reduce insurance premiums, and help protect employers from spurious workers' compensation and wrongful termination claims. It can also save tens of thousands of dollars for guards and overtime spent responding to old style alarms. Organizations are savings money, generating ROI, and by the way they are also safer from terrorism.

Maybe the security example doesn't seem like convergence, so here is how ROI's from discrete systems can lead to convergence. Albuquerque Academy started by implementing energy savings projects with savings that generated dollars to fund campus building automation.

Convergence began to occur when Access Control was integrated and continued with IP video and Digital Tripwires, finally it was integrated with an Ethernet LAN. When issues arose with data communication speed and bandwidth, an 11 megabit per second high speed wireless Internet Backbone was implemented for full system communication.

These systems translate to $200,000+ per year in savings and countless opportunities to improve the mission of education. It's been called "Campus of the Future", but it is really Convergence and the total benefit has yet to be quantified. The critical first step to selling convergence is showing buyers the benefits created by projects like this one. Then the question will change from why should I do it, to how fast can the system come on line?

How sellers sell

Distribution may seem somewhat esoteric, but it is critical to understanding the market. Owners must know what providers can meet their needs, and contractors who want to survive must know the competition, in each case these are sellers.

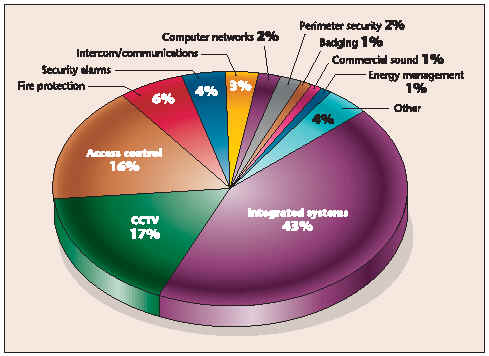

Figure

1 is a

crude attempt at defining the convergence landscape, using the "pie"

analogy, and asking who has pieces of market. The traditional control industry

was dominated by manufacturers, control and HVAC, but this is no longer true.

Several factors caused the change. First, putting Data Protocol standards in

place has essentially paid the price of entry for Internet access, and for use

of off-the-shelf computer technology in automation. This opened the market to

many new providers shown above including: IT, Security / Fire and Web Services.

The Integrator pie chart is from SDM Magazine's Annual Top System Integrator

survey and demonstrates the breadth of convergence being implemented. This is

also being done by Utilities and Energy Services Companies (ESCO's), and opens

the door for Information Technology Convergence, which allows managers to use

all system data to improve decision-making.

Figure

1 is a

crude attempt at defining the convergence landscape, using the "pie"

analogy, and asking who has pieces of market. The traditional control industry

was dominated by manufacturers, control and HVAC, but this is no longer true.

Several factors caused the change. First, putting Data Protocol standards in

place has essentially paid the price of entry for Internet access, and for use

of off-the-shelf computer technology in automation. This opened the market to

many new providers shown above including: IT, Security / Fire and Web Services.

The Integrator pie chart is from SDM Magazine's Annual Top System Integrator

survey and demonstrates the breadth of convergence being implemented. This is

also being done by Utilities and Energy Services Companies (ESCO's), and opens

the door for Information Technology Convergence, which allows managers to use

all system data to improve decision-making.

This is interesting, but what does it really have to do with selling either internally to management or externally to customers.

For automation companies offering technology convergence, the primary issue is that the competition just got stiffer. Countless companies believe they have the skills necessary to offer owners a one-stop shop. Since they also believe all of these systems are similar, they offer owners integration and convenience.

A word of caution, this logic is fatally flawed. Buildings professionals know that HVAC controls are far more complex than most building and data systems. Owners therefore must devise ways to validate vendor skill levels and scrutinize competence. With the number of IT and other vendors offering "bundled" or combined solutions there is a real need to carefully evaluate credentials before committing to providers.

Yet bundled integration is the approach of the future, and therefore owners should carefully consider System Integrators who can implement, commission and service multiple systems. Though they are not common, Comprehensive System Integrators should be sought out. They can provide high quality work and are capable of integrating disparate systems to generate real value.

Remember, many unqualified companies want a piece of this $5 billion convergence market. How sellers sell is basically about business models and several are indicated above. The ESCO's model focuses on a financial sale including guaranteed savings, which typically requires savings measurement and verification, and could be an ideal fit for converging controls and information. This one-stop-shop convergence model can consolidate multiple offerings and avoid traditional contractor finger-pointing.

This strategy may also eliminate competitors who are not capable of delivering convergence.

[an error occurred while processing this directive]There are also evolving business models like "Deep Integration", which come from the real-time service world. TIBCO, the software company, say deep integration is about real-time business, "…which unifies and optimizes business assets, such as people, systems and processes, to coordinate end-to end activities that get information where it is needed." Assume these activities include control of critical systems; HVAC, fire and security, and this clearly defines the future … and Convergence.

Consider the concept of integration depth, shallow integration implies limited access to data and control with minimal functionality. This is the old controls business model. Deep integration implies much more; it is both depth of sophistication and a "breadth" of application. Deeper control logic interaction enhances controller sophistication, but this is just the beginning, it also integrates other systems, i.e. access, fire and security. Anti-tailgating is a deep integration sequence integrating cameras and access control.

The ultimate deep integration is full-scale implementation of the Internet with Web-enabled control for comfort, energy management, security and information technology to support the customers' mission. Deep Integration is the logical conclusion of convergence, though it is a process rather than a conclusion, and can result in Energy Web Services that can go far beyond traditional Automation. Access to real-time information anywhere, anytime through Internet-enabled automation systems, and the ability to integrate that information into automation of an entire enterprise, is the real value of convergence. True integrators will innovate to create value propositions that bring these capabilities to buildings.

There has been a great deal of discussion at AHR and BuilConn about IT and Web-based devices, but it isn't clear to owners if there is real value in this technology. The challenge is therefore to develop deep integration competency and innovate to both sell and deliver the benefits of convergence.

UNDERSTANDING AND MAKING THE BUSINESS CASE

As with all business decisions, owners must analyze opportunities for convergence, and determine what makes sense. Many control companies will chose not to participate in convergence and they will slowly lose market share. Owners will not want to do business with these companies, as they will decline and their service is likely to suffer over time. Controls will also become commodities and the lowest price will leave little opportunity to add value or make a profit.

| One potential future for control integrators is as fourth- tier subcontractors, installing commodity products for information technology providers. However, this is not an acceptable definition of the future for either Integrators or informed building owners. As a result the appropriate course of action is to drive the market. |

Businesses that want to survive should consider where the industry is headed, what customers want and how to develop a business case for the future. This is not a decision for engineers, manufacturers and contractors though; owners must participate and aggressively drive the market toward a business model that will meet their needs.

The traditional bid-and-spec approach has driven building construction to the lowest common denominator, and it should be unacceptable. It is foolish to think that this cathartic period of change in the integration business can be controlled, yet short of control there is an opportunity for informed and energetic early adopters to drive the market in the right direction.

Rather than a process of haphazard migration, this active participation in driving the market could result in a new Integration market that is driven by customer need and not low bid. The wild card in this entire discussion is that impending forces from outside the traditional control industry in the form of IT providers and others want to add Integration technology to a special systems offering.

One potential future for control integrators is as fourth-tier subcontractors, installing commodity products for information technology providers. However, this is not an acceptable definition of the future for either Integrators or informed building owners. As a result the appropriate course of action is to drive the market. Integrators must establish for the owner that only they can offer the technology competency, the value and the long-term service that are critical to building optimization.

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The Automator] [About] [Subscribe ] [Contact Us]