|

December 2018

AutomatedBuildings.com

|

[an error occurred while processing this directive]

(Click

Message to Learn More)

|

Facilities as Strategic Assets

Navigating the digital transformation of Building Products and Services

|

Dan Diehl, CEO, Aircuity

Paul O'Malley Associates, LLC

Lou Ronsivalli, Principal, GioVantage Strategies, LLC

|

The Building Products, Services and Solutions Industry is being transformed

Like

many industries before it, the market for commercial building products,

services, and solutions (BPSS) is undergoing a digital transformation.

This sector has been a relative innovation laggard for several reasons,

including the long lifecycles of buildings and major building systems;

the fact that each building is somewhat unique, requiring engineered

systems; and the win/lose legacy culture that traces its roots to the

hardball construction industry.

Nevertheless, we believe the market is being transformed, and that the

pace of change is accelerating. In this article, we share our view on

how the transformation is likely to play out, and which companies are

most likely to succeed in the new environment. Are there companies

poised to become the Googles, Amazons or Salesforces of the BPSS

industry? What strategies or business models will the successful

companies adopt?

Transformation

patterns in other industries: from doing the same things more

efficiently, to doing things that were previously not possible

In

many of the early digital transformations, innovators used web

technology to improve upon the way things had been done in a given

industry. Amazon made it easier to find and purchase a book or CD.

Netflix made it easier to rent DVDs through the mail with an innovative

subscription model. Salesforce made it simpler to adopt CRM software

via its pioneering SAAS (Software As A Service) model.

As the digital revolution has evolved, and the technologies have

advanced, the second phase of innovation has seen successful companies

fundamentally redefine entire industries, with new value propositions,

new business models and new cultures. Amazon has become a retail

platform that leverages crowdsourced customer reviews, uses analytics

to predict what each customer wants, and enables third-party sellers

alongside its own offerings. Netflix migrated to streaming,

becoming the dominant player, and is now using its massive customer

data set to design original programming that will appeal to specific

segments of viewers. Salesforce has become a business solutions

platform, branching out from CRM to include service management, and

introducing its Lightning platform that allows customers and

third-party developers to more easily customize or create applications.

As discussed below, the winners of the BPSS digital transformation will

develop these kinds of phase-two solutions that redefine the industry.

Forces driving change in BPSS

Several factors are accelerating the pace of change in BPSS:

- Customers are dissatisfied with legacy vendor solutions that

don’t deliver and demonstrate compelling value. For example, in many

situations, services are being sold as the “what?” (scheduled on-site,

truck roll-based PM services) and the “how?” (delivery of ‘hours’ as a

commodity and check-the-box task completion) rather than the “why?”

(increased uptime reliability, sustained levels of occupant

experience). But progressive buyers of services are increasingly less

willing to pay for BAS or chiller service agreements that are based on

labor rates and hours. They are much more willing to pay for

performance, tying service fees to verified outcomes, such as critical

equipment uptime.

- Customers’ expectations have been raised by the innovative,

responsive and customer friendly companies they deal with in other

parts of their business and personal lives (Salesforce, Amazon, Uber,

etc.).

- SCADA systems are commoditizing BAS offerings and eroding the “lock-in” power of their proprietary products.

- ASHRAE is helping drive the adoption of open protocols and metadata definitions with its proposed standard 223P announced in February of 2018.

- The combination of IoT, big data, cloud-based platforms, and

analytics are undermining the value and profitability of legacy

products and services, while simultaneously enabling higher value, more

profitable solutions.

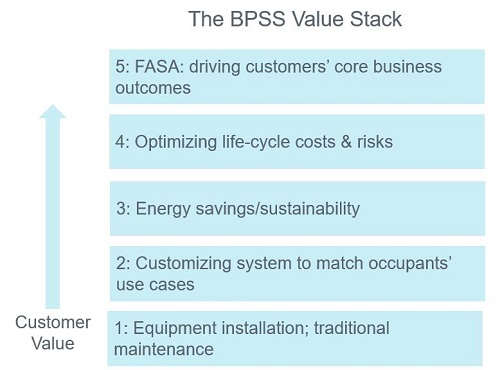

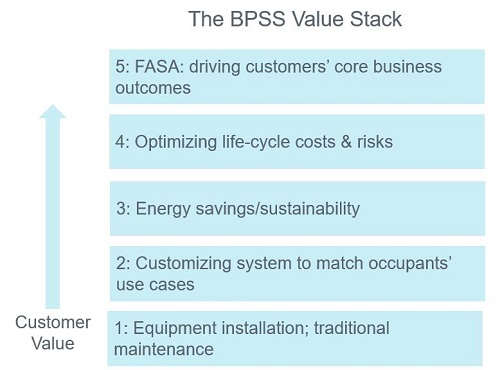

Moving up the value stack: facilities as strategic assets

In

response to commoditization and changing customer expectations, the new

technologies are first being used to make existing service models more

efficient. Instead of sending a BAS or HVAC technician to do a

preventive inspection, or to troubleshoot a problem, forward-thinking

solution providers are using remote monitoring and analytics to perform

those tasks more effectively and at a lower cost. New technologies also

allow them to demonstrate the value they are creating by documenting

critical outcomes, including equipment uptime, space conditions

(including IEQ) and energy consumption. This approach is still somewhat

innovative, but it will rapidly become table stakes, the standard for

doing business at the bottom of the BPSS value stack.

Further

up the value stack are solutions that leverage data and analytics to

provide guaranteed service level agreements (SLAs), in which the

customer pays a variable fee based on verified outcomes achieved and

sustained. Another set of higher value offers will be based on

lifecycle management and long-term asset planning. For example, a

solution provider may guarantee the ten-year lifecycle costs of a

chiller and take responsibility for installation, continuous

commissioning, maintenance, any required rebuilds, cooling and energy

performance, and financing. Or the service company may own the chiller

and related equipment, providing chilled water as a service.

Further

up the value stack are solutions that leverage data and analytics to

provide guaranteed service level agreements (SLAs), in which the

customer pays a variable fee based on verified outcomes achieved and

sustained. Another set of higher value offers will be based on

lifecycle management and long-term asset planning. For example, a

solution provider may guarantee the ten-year lifecycle costs of a

chiller and take responsibility for installation, continuous

commissioning, maintenance, any required rebuilds, cooling and energy

performance, and financing. Or the service company may own the chiller

and related equipment, providing chilled water as a service.

At the top of the value stack, are solutions based on an approach that we call FASA or Facilities as Strategic Assets. The vendors and customers who adopt this approach view facilities as strategic assets that must be managed to drive the success of the customer’s core business. Their goal is to manage the design, maintenance, operation and retrofitting of buildings to measurably improve business (not just building) outcomes.

Similar to the pattern in other industries, the solutions higher up in

the BPSS value stack will be enabled by a flexible value-creation

ecology based on digital platforms that collect, analyze and learn from

building and business data.

FASA strategies focus on vertical markets

Because

FASA solutions start with critical business outcomes, FASA vendors must

develop a deep understanding of their customers’ businesses. This

usually means focusing product development, marketing, and sales on the

high-priority needs of companies in vertical markets.

Example FASA strategies in vertical markets

- Technology: A leading

manufacturer of networking equipment negotiated a performance-based

agreement, in which its HVAC service company is paid an annual fee to

assure uninterrupted cooling availability for servers that perform

mission-critical simulations. The agreement includes large financial

penalties that the service company is charged in the event of an

interruption. It is up to the service company to decide what strategies

to employ to avoid such outages, i.e., the mix of maintenance,

redundant equipment, remote monitoring, etc. There are no contractually

scheduled truck rolls, task checklists or specified hours beyond an

annual total system performance assessment. This outcomes-based, FASA

agreement has benefitted both parties, expanding the value pie. The

service company received a multi-year agreement at attractive margins,

reflecting the responsibility they were taking on, and the business

value they were delivering. The manufacturer enjoyed largely

uninterrupted operation of a critical business process and gained a

true partner who understands its core business priorities, and actively

“looks around corners” on its behalf.

- K-12: A Wisconsin

school district has put the educational mission at the center of its

facilities management process and capital plan, with students’ academic

achievement and personal growth as the number one objective. Every

member of the facilities staff is bonused based on student test scores!

- Life Science: Alexandria Real Estate

develops and manages the lab and office space for the Life Science

industry. Leveraging deep expertise in the science and technology

verticals they serve, they provide their tenants “..dynamic ecosystems

to accelerate discovery and commercialization1.” Per Forbes

Magazine, “…since 1998 Alexandria Real Estate Equities has tripled the

performance of the NASDAQ, quadrupled returns of the S&P 500, and

quintupled the Russell 2000. Alexandria has even outperformed

technology stalwart Microsoft, and investment guru Berkshire Hathaway

by 230%2.”

- Commercial Office: WeWork

began as a shared office space provider. It used innovative design to

decrease the amount of square footage per employee while making the

spaces more inviting and productive. It now collects and mines data

from its large number of customers and buildings to improve its design

and operational standards to drive employee productivity, wellness,

retention, etc. further. WeWork is now providing services to large

enterprise customers, helping them utilize space more efficiently,

while also improving business outcomes. Privately held, WeWork has

reportedly raised more than $4 billion in funding and was valued at $20

billion in a July 2017 funding round3.

_________________________

The Industry Profit Pool will migrate up the value stack

As

has been the case in other industries, the BPSS profit pool will

migrate away from the companies offering legacy products and services

and to those offering higher value solutions. We believe FASA solutions

will capture a large share of industry profits in the years ahead.

By their nature, FASA solutions are on the radar screen of C-Level

decision makers. Companies offering these solutions will sell at the

C-level and have the opportunity to become trusted business partners.

That can lead to long-term relationships in which a FASA vendor deploys

its solutions across a customer’s entire facilities portfolio This can

streamline the procurement process, shorten the sales cycle and reduce

the cost of sale—to the benefit of both parties.

Culture is critical

In

order to benefit fully from the evolution of FASA strategies, the

cultures of vendor and customer organizations must also evolve. Some of

the key assumptions and values that need to be revisited include:

An abundance mentality

[an error occurred while processing this directive]Compared

to the culture of Silicon Valley, many organizations and professionals

in BPSS have a scarcity mentality, tending to view their business

interactions as a zero-sum game. We believe that this is in part due to

the legacy culture of the construction business and the

Design>Bid>Build process. Whether in new construction or retrofit

projects, the procurement process often focuses on the first cost

instead of lifecycle value. This creates perverse incentives for

vendors to “compete by cutting corners.”

FASA strategies require an abundance or win/win mentality. The goal for

vendors is to innovate to create new pools of value that can be shared

between the vendor, the customer and other partners in the value

ecology.

Role and status of BPSS vendors and facilities leaders

Another

inhibitor of FASA innovation has been the legacy cultural assumption on

both the vendor and customer sides that facilities are primarily a cost

center to be minimized. This can create a self-fulfilling

prophecy, in which C-level buyers fail to put FASA vendors and

solutions on their radar screens and fail to engage their own

facilities leaders as top-level contributors within their management

teams.

There are opportunities for solution providers and facilities leaders

on the customer side to enhance their standing as full partners in the

success of the customer’s business, helping move the needle on critical

business outcomes. By demonstrating that FASA strategies can create

core business value, they will be seen as business leaders and will

earn full participation in the management of the business, not just the

buildings.

Focus on innovation, learning and operational excellence: profit is not the purpose

In

the era of big data and analytics, customers will have more and more

information about the value of facilities-related products and

services. Vendor strategies based on customers having incomplete

information or based on lock-in to proprietary products will be less

and less viable.

In this environment, sustainable profitability is best seen as the

outcome of creating verifiable business value for customers. In

strategy development and in the day to day execution, the most

successful companies won’t solve to profitability. They will solve to

creating customer value in some unique, differentiated way, with a

business model that allows them to capture a fair share of the value

pie as profit.

Ultimately, that focus on creating unique business value for customers

is the essence of the approach we are advocating, a compass that can

guide solution providers and building owners as they navigate the

digital transformation of the BPSS industry by developing FASA

strategies.

footer

[an error occurred while processing this directive]

[Click Banner To Learn More]

[Home Page] [The

Automator] [About] [Subscribe

] [Contact

Us]

Further

up the value stack are solutions that leverage data and analytics to

provide guaranteed service level agreements (SLAs), in which the

customer pays a variable fee based on verified outcomes achieved and

sustained. Another set of higher value offers will be based on

lifecycle management and long-term asset planning. For example, a

solution provider may guarantee the ten-year lifecycle costs of a

chiller and take responsibility for installation, continuous

commissioning, maintenance, any required rebuilds, cooling and energy

performance, and financing. Or the service company may own the chiller

and related equipment, providing chilled water as a service.

Further

up the value stack are solutions that leverage data and analytics to

provide guaranteed service level agreements (SLAs), in which the

customer pays a variable fee based on verified outcomes achieved and

sustained. Another set of higher value offers will be based on

lifecycle management and long-term asset planning. For example, a

solution provider may guarantee the ten-year lifecycle costs of a

chiller and take responsibility for installation, continuous

commissioning, maintenance, any required rebuilds, cooling and energy

performance, and financing. Or the service company may own the chiller

and related equipment, providing chilled water as a service.